Small businesses, including those eligible in Magnolia, received a $370 billion lifeline in the $2 trillion Coronavirus Aid bill approved Friday by the U.S. House of Representatives, and signed into law by President Donald Trump. The largest stimulus in U.S. history, the bill includes relief for taxpayers, the unemployed, and large corporations as well as small businesses.

For an excellent synopsis and for printing and available as a working resource, click here.

We strongly urge all small businesses who are interested in learning more and taking advantage of this unprecedented stimulus and relief package to work with your bank to explore how to best proceed.

Loans Under Paycheck Protection Program (Section 1102)

Section 1102 of the CARES Act provides $350 billion for expedited individual loans up to $10 million through approved lenders that are guaranteed 100 percent by the U.S. government.

The loan proceeds can be used to:

-

Cover payroll support, such as employee salaries, paid sick or medical leave, insurance premiums, and mortgage, rent, and utility payments incurred from February 15, 2020, through June 30, 2020.

-

The maximum amount of a loan equals 2.5 months of regular payroll expenses (subject to a cap of a $100,000 of annual salary per employee).

Benefits for Borrowers:

Borrowers are eligible for loan forgiveness equal to the amount spent by the borrower during an eight week period after the origination date of the loan on payroll costs, interest payment on any mortgage incurred prior to February 15, 2020, payment of rent on any lease in force prior to February 15, 2020, and payment on any utility for which service began before February 15, 2020.

Borrower and lender fees are waived.

Collateral and personal guarantee requirements are waived. The maximum interest rate is four percent and loan maturity can be as long as 10 years.

No prepayment fees will be charged. Loan payments can be deferred for 6-12 months.

Benefits for Lenders: Allows loans to be sold on the secondary market. Provides the regulatory capital risk weight of loans made under this program, and temporary relief from troubled debt restructuring (TDR) disclosures for loans that are deferred under this program. Lender compensation for servicing the loan is five percent for loans of not more than $350,000; three percent for loans of more than $350,000 and less than $2,000,000; and one percent for loans of not less than $2,000,000.

Eligible businesses include:

-

Businesses with fewer than 500 employees.

-

Small businesses as defined by the Small Business Administration (SBA) Size Standards at 13 C.F.R. 121.201.

-

501(c)(3) nonprofits, 501(c)(19) veteran’s organization, and Tribal business concern described in section 31(b)(2)(C) of the Small Business Act with not more than 500 employees.

-

Hotels, motels, restaurants, and franchises with fewer than 500 employees at each physical location without regard to affiliation under 13 C.F.R. 121.103.

-

Businesses that receive financial assistance from Small Business Investment Act Companies licensed under the Small Business Investment Act of 1958 without regard to affiliation under 13 C.F.R. 121.10.

-

Sole proprietors and independent contractors.

Application Process:

Current lenders through the Small Business Administration 7(a) are authorized to make determinations on borrower eligibility and creditworthiness without going through the SBA. These lenders can be found here. For eligibility purposes, lenders will not be determining eligibility based on repayment ability, but rather whether the business was operational on February 15, 2020, and had employees for whom it paid salaries and payroll taxes, or a paid independent contractor.

Timeline:

The SBA is required to issue implementing regulations within 15 days and the U.S. Department of Treasury will be approving new lenders.

Economic Injury Disaster Loans (Section 1110)

Section 1110 of the CARES Act expands the types of entities eligible to receive up to $1.5 million in direct loans from the Small Business Administration and loan guarantees for substantial economic injury caused by the COVID-19 pandemic.

Substantial economic injury is such that a business concern is unable to meet its obligations as they mature or to pay its ordinary and necessary operating expenses.

The loan proceeds may be used for working capital necessary to carry your concern until resumption of normal operations, expenditures necessary to alleviate the specific economic injury, providing paid sick leave to employees, maintaining payroll, meeting increased costs to obtain materials, making rent or mortgage payments and repaying obligations that cannot be met due to revenue losses.

New Eligible Entities:

-

Any business with fewer than 500 employees.

-

Tribal businesses as defined by 15 U.S.C. 657a(b)(2)(C) with fewer than 500 employees.

-

Cooperatives with fewer than 500 employees.

-

ESOPs as defined by 15 USC 632 with fewer than 500 employees.

-

Individuals operating as a sole proprietor or an independent contractor during the covered period (January 31, 2020 to December 31, 2020).

Other Eligible Entities:

-

Small businesses as defined by the Small Business Administration Size Standards at 13 C.F.R. 121.201.

-

Private non-profits with exemptions under sections 510(c), (d) or (e) of the Internal Revenue Code.

Application Process:

The loan form is found at:

https://www.sba.gov/sites/default/files/files/serv_da_all_loanapp_2_0_0_3.pdf

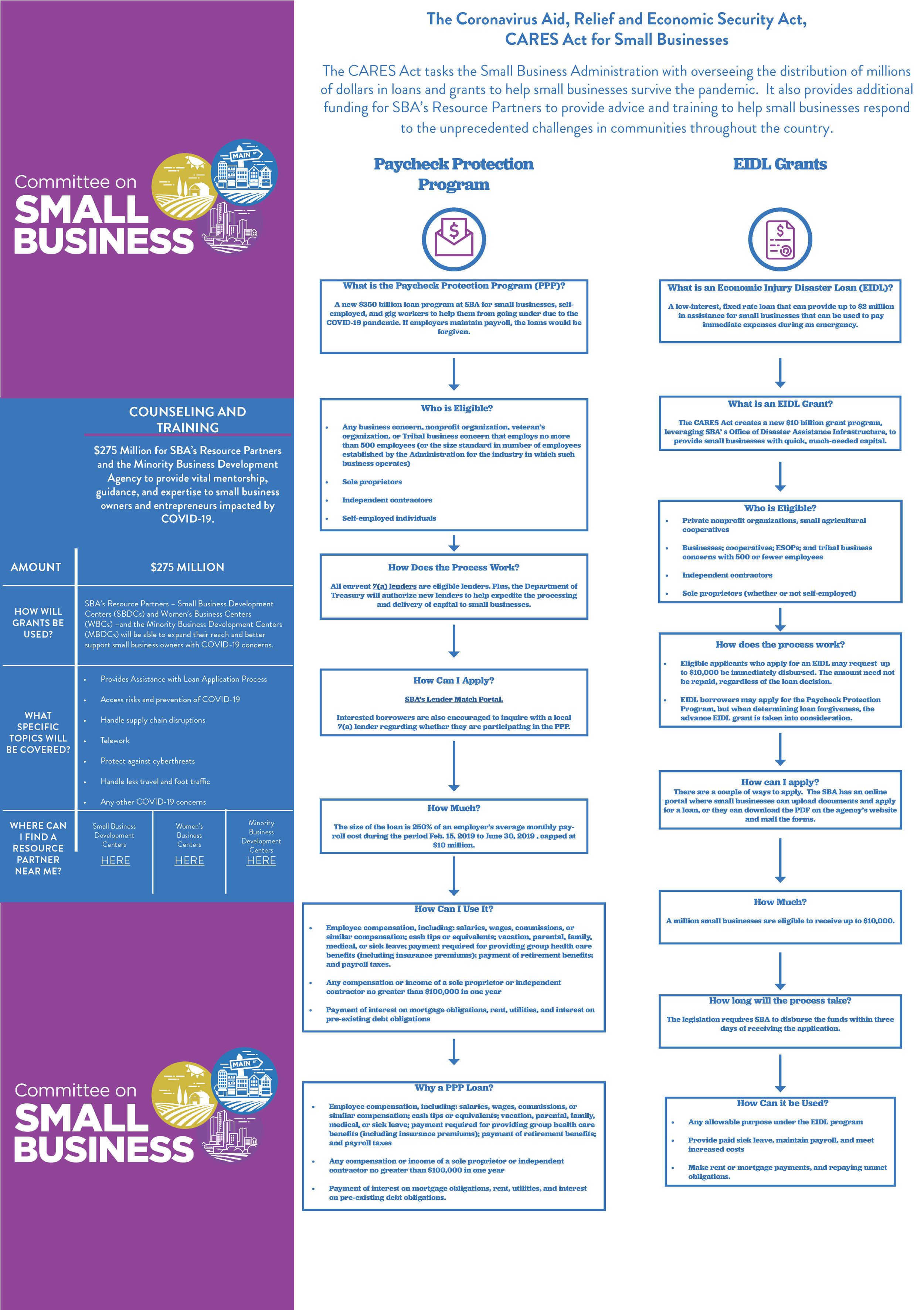

CARES Act flow chart

Click image below to enlarge; click here for PDF.